People are struggling to understand the low prices of oil. Some say it is a result of competitive production, where OPEC doesn’t want to cut back because it thinks Russia will fill the gap. The US doesn’t want to cut back on its own tar sands (Ok, its in Canada, same difference) because it doesn’t want ever to be sensitive to Middle Eastern politics again. All are offering oil to the market, so the price is low?

The price of oil is low because there is more oil than money to buy it. This depends on the amount of oil as much as it depends on the amount of money.

No, that’s not the whole story. Because we buy oil with USD (primarily) and who makes them? The USA’s federal reserve, which is a private bank. This is important because if you are an arab with a ship full of crude oil and you have to hand that oil over for paper printed in the US, you may not want to do that. Although the US dollar is used in many regions to produce many interesting products, why would you need so many right now. Why sell oil for paper if you have a choice.

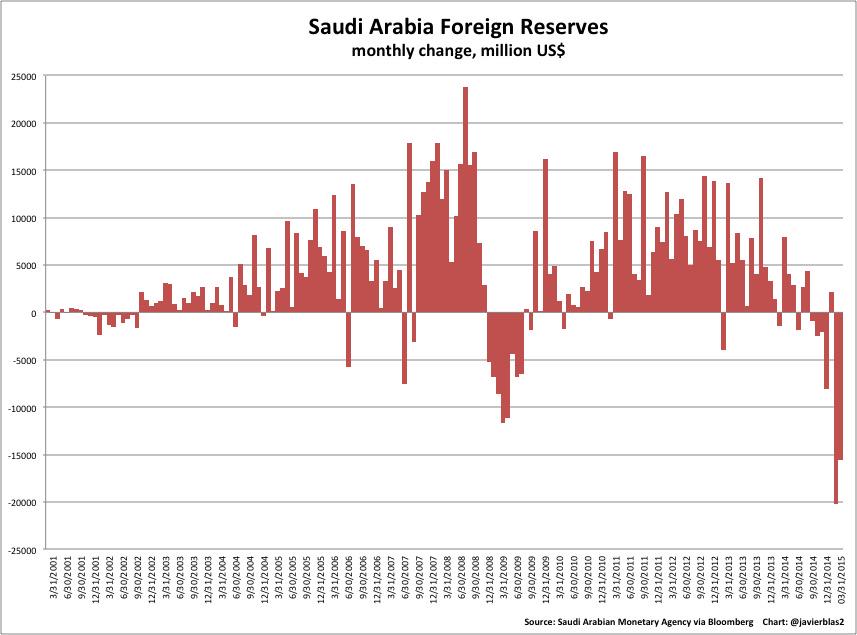

Actually Saudi arabia doesn’t seem to have a choice. It has to earn money because it is running out of USD. The country ships millions of barrels of oil to the world every day, and still it is running low. This is strange. It must have something to do with banks.

Banks determine oil prices by controling the amount of credit

Banks play a major role in the situation. If they increase the amount of money by providing credit for big projects, the demand for fossil fuels will go up (that money will be spend on fossil fuels in the proces of realizing the projects) and the price of oil goes up. In fact, banks only have to lend to speculators and the price of oil will go up. Banks print money, that is something everyone needs to fully appreciate, they can create it when they want it, although they prefer to do it with a good excuse, for instance an asset. But anything close to an excuse is usually enough, like a dot.com company or a portfolio of NINJA loans. What matters is if the creation of credit makes them more powerfull, or at least keeps them as powerfull as they already are.

If there is more credit, it will increase the number of people buying fossil fuels, which will increase the price of oil

It seems today, Saudi Arabia can’t raise the oil price to pay their costs, and it can also not tell those needing USD (banks with creditors) to go fuck themselves. The Saudi money reserves are depleted by Wallstreet obligations, possibly through the decades old mechamism described by the ‘economic hitman’, who explained the Wallstreet banks make Saudi Wealth (USD) disappear to keep them hungry for more, in return for oil.

Direct trade of oil in other currencies has been fought by the US in many instances, because it would reduce the total pool the US could freely make use of by printing dollars.

It seems there is a fight going on that the oil producers can’t win because they don’t control the currency their oil is traded in. They throw the barrels on the market, but unlike in the 50s and 70s (after they negotiated a pay rise) the response is not an economic ‘boom’ accompanied by more credit creation and subsequent higher prices. The banks are against, as is shown from dutch central bank director Knot who remarked that ECB quantitive easing programs where ‘unnecessary’. European QE is happening, so this fact doesn’t yell with the idea banks are against more credit, but off course they didn’t realize that Europe wants to do the same thing the US has been doing for a decade now : print money and buy oil. And it is after all a Coal and Steel uninion.

Putin has been making gas deals to make ends meet and expand his options to sell outside the influence of USD banks. Because those banks force him to squander his oil?

It seems that whatever the banks want, they are in charge, and all the countries that produce oil are either inclinde strategically to keep producing (US) or have to because of their financial engagements, with the same banking sector that is refusing to print more money to drive up demand and enable them to pay their bills.

On the other hand, nobody ever hears the whole story of oil production, it may well be that wells can’t slow down production for technical reasons. It may also be production is dropping along with credit.

This situation thus is either a recepy for war (f.i. between creditors of Russia and Russia) or for the economic enslavement of all oil producing countries that need dollars.

The upside of banks refusing to increase credit is that there are less CO2 emissions

It is so typical of banks controlling the game, that when things go wrong for Saudi Arabia, they don’t get into a fight with their bank, but with the creditor that thought it was investing dollars in Saudi Arabia. While all the while the dollars only had value because they bought oil from the same, Saudi Arabia or some other place. The banks thus play both sides, armed with a printing press and neat suits, hubris and complex instruments, and the oil producers (for now) are the sucker.